Car Finance Deals

Alternative to car dealer finance.

Car Finance from £50,000

PCP, Hire Purchase and Lease Purchase options

Market leading rates from 9.9% APR

Fast approval and funding process

Award winning service

Fast Car Finance in as Little as 1 Hour!

Final step to get your free quote

As featured in

Car finance made simple

We’ll guide you through the application and manage

the whole process until your capital is secured

Get a quick quote

Find out how much can lend based on your requirements by using our calculator or speaking to a member of the team.

Chat to us

Speak to one of our expert brokers who will discuss your specific requirements and identify any complexities and opportunities with regards to your eligibility.

Your finance arranged

Your broker will compare rates across the entire market and negotiate the best deal for you, based on your circumstances. They will guide you through every step of the process until your loan is secured.

Our success stories

Through our market knowledge, we can deliver enhanced, bespoke or exclusive terms based on your requirements.

Capital raised

£387k

Aston Martin Zagato Speedster Lease Purchase

We utilised a specialist format of a Lease Purchase product whereby the customer would pay a 50% deposit down payment for the vehicle with a 50% residual value at the end of the agreement term, providing the customer the option to purchase at the end. This making the high vehicle value more appealing to prospective buyers.

Capital raised

£84k

Finance of Tesla Model X Left Hand Drive

Our client sought a director's vehicle but faced challenges securing it through the business. We facilitated the process by placing the vehicle in the client's personal name, resulting in instant approval. The client is now excited to purchase a Tesla Model X, showcasing our commitment to finding tailored solutions for individual needs.

Capital raised

£300k

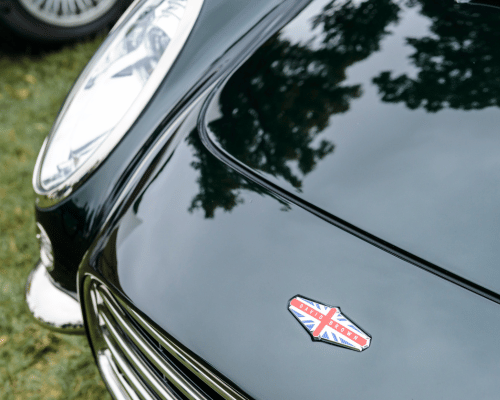

Loan to Finance Purchase of Aston Martin DB6

There was quite a lot of interest in this car, and the client needed to act quickly to secure the purchase. Speed was of the essence, and from the start, the finance was in place in less than 2 weeks.

Capital raised

£55k

Refinance of Range Rover Sport

Our client approached us looking to refinance their existing PCP deal. We were able to secure a hire purchase agreement which allowed the client to pay off the final balloon payment and keep the car.

Be one of our success stories

Frequently asked questions

We're happy to answer any questions or queries you might have when it comes to your enquiry. Here are some that our other clients found useful.

What is car finance?

Car finance refers to various financial products that allow individuals to purchase or lease a vehicle without paying the full price upfront. It typically involves making a down payment and then repaying the remaining balance through monthly instalments over a set period.

Common types include hire purchase, personal contract purchase, and leasing, each offering different terms and ownership options.

However, you will typically pay a regular amount over pre-arranged period to use the asset, which can make the overall cost more manageable.

What types of car finance are there?

There are several common types of car finance options available:

1. Hire Purchase (HP) allows you to pay a deposit and then make monthly payments over a set period. You own the car once all payments are made.

2. Personal Contract Purchase (PCP) involves paying a deposit and making lower monthly payments, with a large final payment to own the car at the end of the term.

3. Leasing lets you use a car for a fixed period, making monthly payments, but you return the car at the end of the lease without ownership.

4. Personal Loans can also be used to buy a car, providing a lump sum to purchase the vehicle outright.

Is it easy to get car finance?

Getting car finance can be relatively easy, especially if you have a good credit score and a stable income. Lenders typically look for these factors when assessing applications.

However, the ease of approval can vary based on your financial situation, the type of finance you choose, and the lender's criteria.

How quickly can I get car finance?

The speed of obtaining car finance can vary, but typically, you can receive approval within a few hours to a couple of days.

For a smooth process, ensure you have all necessary documents ready, such as proof of income and identification. Once approved, funds can often be available quickly, allowing you to finalize your vehicle purchase.

Why Clifton Private Finance?

We are financial experts, specialising in sourcing vehicle & asset finance for personal & business purposes across the UK.

We can help you:

-

Understand what kind of loans you're eligible for and how much you can borrow.

-

Feel comfortable with how the process works and explain any costs.

On your behalf, we will:

-

Compare rates across the entire market (from private lenders to high street banks)

-

Negotiate the best deal for your circumstances

-

Guide you through the application process

-

Make sure your application is completed as smoothly and stress-free as possible