Let's get a vehicle finance deal that is perfect for you!

High-quality vehicle finance solutions.

Award Winning Service

Funding up to £500K within 24 hrs

Dedicated specialist Vehicle Finance team

Vehicle finance in as little as 24 hours!

Final step to get your free quote

As featured in

Vehicle finance made simple

We’ll guide you through the application and manage

the whole process until your capital is secured

Get a quick quote

Find out how much can lend based on your requirements by using our calculator or speaking to a member of the team.

Chat to us

Speak to one of our expert brokers who will discuss your specific requirements and identify any complexities and opportunities with regards to your eligibility.

Your finance arranged

Your broker will compare rates across the entire market and negotiate the best deal for you, based on your circumstances. They will guide you through every step of the process until your loan is secured.

Our success stories

Through our market knowledge, we can deliver enhanced, bespoke or exclusive terms based on your requirements.

Capital raised

£300k

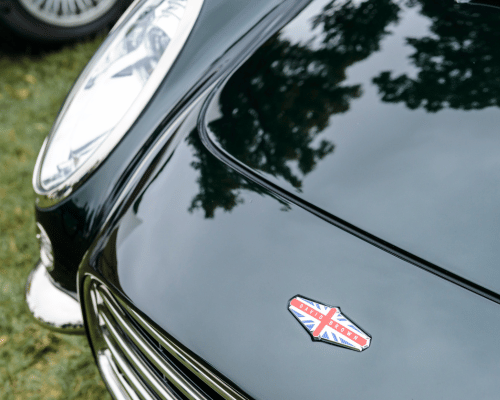

Loan to Finance Purchase of Aston Martin DB6

There was quite a lot of interest in this car, and the client needed to act quickly to secure the purchase. Speed was of the essence, and from the start, the finance was in place in less than 2 weeks.

Capital raised

£150k

Fast Business Loan for Expanding Fitness Gym

Our client approached us as the founder of a successful fitness gym offering personal training and classes, which he wanted to expand into two new locations in London.

Capital raised

£110k

Motorhome Finance for Frankia QD Platin Mercedes

The owner of an electrical engineering business required accommodation for his employees working away from home on large commercial contracts.

Frequently asked questions

We're happy to answer any questions or queries you might have when it comes to your enquiry. Here are some that our other clients found useful.

What is asset finance?

Asset finance allows businesses and individuals to acquire and use assets, such as equipment, machinery, vehicles, or real estate, without paying the full cost upfront.

It is a common method for businesses to obtain the necessary assets for their operations without tying up a significant amount of capital.

There are several different types of asset finance, and the structure of your loan will depend on the type of asset finance that you opt for.

However, you will typically pay a regular amount over pre-arranged period to use the asset, which can make the overall cost more manageable.

What types of asset finance are there?

There are six primary forms of asset finance:

-

Hire purchase

-

Finance leasing

-

Equipment leasing

-

Operating leasing

-

Contract hire

-

Asset Refinancing

Each type of asset finance has its own advantages and considerations, and the choice of which one to use depends on the nature of the asset, the financial situation of the business, and its long-term goals.

At Clifton Private Finance, our team of experienced finance brokers can help you find the most suitable asset finance solution for your business.

Is it easy to get asset finance?

Asset finance can be easy to access in comparison to long-term loans like mortgages. However, different types of asset finance have varying eligibility criteria and requirements.

Lease agreements and hire purchase agreements may be more accessible for businesses and individuals with lower credit scores compared to unsecured loans or lines of credit.

Generally, your credit history and financial health play a significant role in the ease of obtaining asset finance - but this can vary.

Some types of asset finance, like hire purchase and asset-based lending, involve using the financed asset as collateral.

In such cases, the lender may be more willing to approve the finance because they have a tangible asset as security. This can make it easier to obtain financing (and potentially better rates).

How quickly can I get asset finance?

In many cases, applying for asset finance is straightfoward, and applications can be approved in less than 48 hours.

For more complex cases, acquiring asset finance may take longer due to any additional paperwork that may be necessary.

But if you need to meet a deadline, you may be able to have your application prioritised for an additional charge.

Why Clifton Private Finance?

We are financial experts, specialising in sourcing asset finance for business purposes across the UK.

We can help you:

-

Understand what kind of loans you're eligible for and how much you can borrow.

-

Feel comfortable with how the process works and explain any costs.

On your behalf, we will:

-

Compare rates across the entire market (from private lenders to high street banks)

-

Negotiate the best deal for your circumstances

-

Guide you through the application process

-

Make sure your application is completed as smoothly and stress-free as possible